General Motors Co. and Tesla Inc. have taken divergent approaches when it comes to returning capital to shareholders, highlighting contrasting strategies that could shape their long-term market positions.

General Motors: Rewarding Shareholders

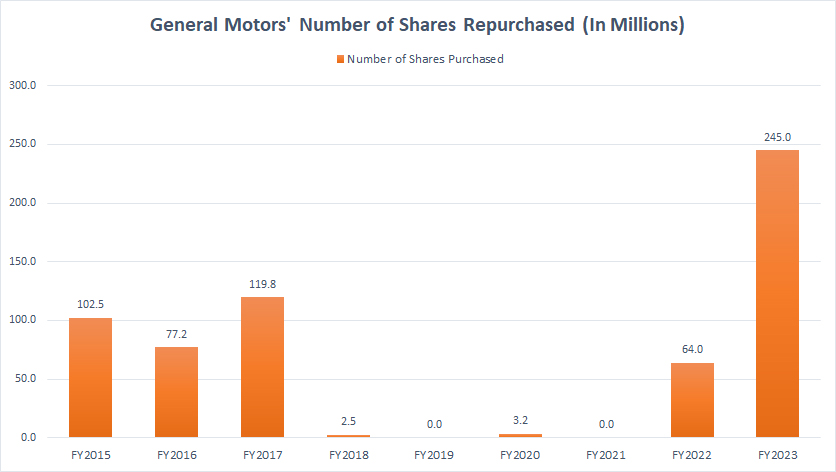

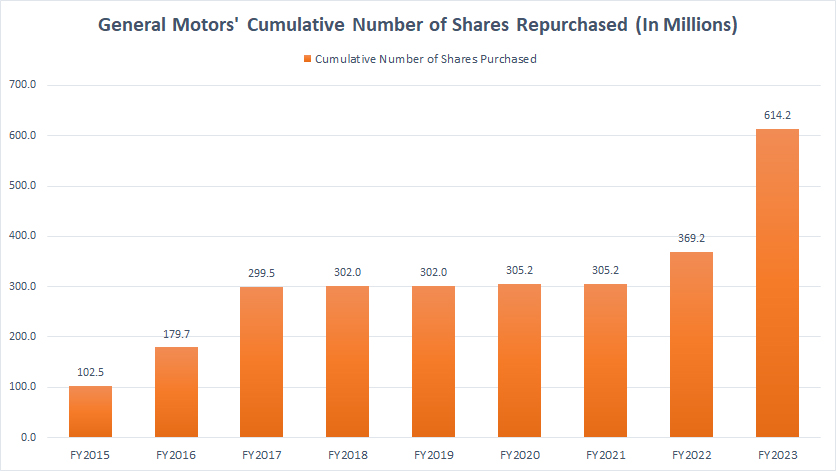

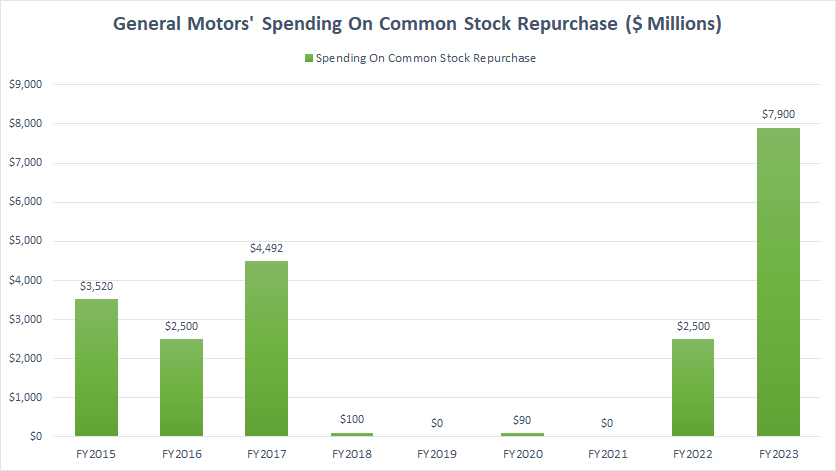

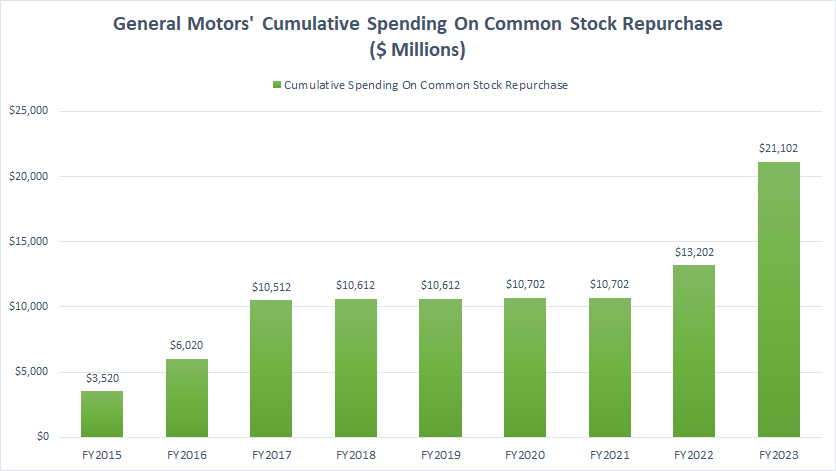

Detroit-based General Motors has leaned heavily on share repurchases and dividend increases to boost shareholder returns. In February 2025, the automaker announced a $6 billion share buyback program and raised its quarterly dividend by 25% to $0.15 per share. The move signals GM’s confidence in its financial position while catering to investors seeking stable, near-term returns.

By reducing the number of outstanding shares, buybacks can increase earnings per share (EPS) and support GM’s stock price. Combined with dividend payouts, these measures make GM attractive to income-focused investors and help maintain market confidence.

However, the company’s capital allocation strategy also raises questions about its long-term growth ambitions. As the auto industry transitions toward electric vehicles (EVs) and autonomous driving, GM’s heavy spending on buybacks could limit resources for innovation and future product development. Critics caution that prioritizing shareholder returns over long-term investment may hinder GM’s ability to keep pace with industry disruptors.

Tesla: Betting on Expansion

Tesla, by contrast, has refrained from conducting stock buybacks despite growing cash reserves. Chief Executive Elon Musk has floated the possibility of a buyback, suggesting in 2022 that the company might spend between $5 billion and $10 billion repurchasing shares. However, Tesla has yet to move forward with such a plan.

Instead, the electric vehicle maker has focused on reinvesting profits into expanding manufacturing capacity, developing new products like the Cybertruck, and enhancing its self-driving technology. Tesla’s strategy reflects a long-term growth mindset, with the company favoring innovation and infrastructure investment over immediate shareholder returns.

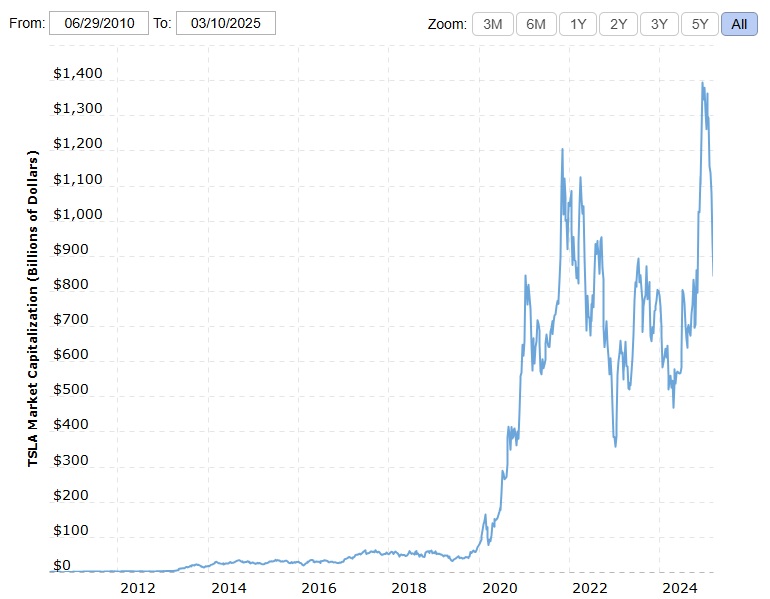

This approach has propelled Tesla to a dominant position in the EV market, driving rapid revenue growth and boosting its market valuation. However, it comes at the expense of short-term shareholder benefits, potentially leaving income-focused investors disappointed.

Different Paths, Different Outcomes

The contrasting strategies underscore the different stages of business maturity and market positioning. GM, with a stable cash flow and legacy operations, has chosen to prioritize shareholder returns through buybacks and dividends. Tesla, still in rapid growth mode, remains focused on capitalizing on future opportunities in electric vehicles, autonomous driving, and energy solutions.

The long-term impact of these strategies remains to be seen. GM’s buyback-driven approach may sustain stock price stability and satisfy income-focused investors in the short term. However, if the company underinvests in transformative technologies, it risks losing ground in the fast-evolving auto market. Tesla, on the other hand, is betting that aggressive reinvestment will solidify its competitive edge – though it carries the risk of alienating shareholders seeking immediate returns.

For investors, the choice is clear: GM offers steady dividends and buybacks, while Tesla promises long-term growth and innovation – but with no guarantees.